SEE ALSO: Carl Icahn Stalks Lionsgate: His Next Steps

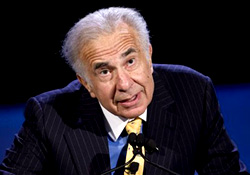

Lionsgate sent its shareholders yet another lengthy letter on Wednesday, urging them to resist the advances of Carl Icahn, the corporate raider who is trying to take over the studio.

Lionsgate sent its shareholders yet another lengthy letter on Wednesday, urging them to resist the advances of Carl Icahn, the corporate raider who is trying to take over the studio.

This one highlights in detail what Lionsgate says is Icahn’s “history of value destruction.”

Here’s the letter in full:

June 14, 2010

Dear Fellow Lionsgate Shareholder:

As you may know, the offer by Carl Icahn and certain of his affiliated entities (the “Icahn Group”) to purchase up to all of the shares of Lionsgate for U.S.$7.00 per share in cash is set to expire this Wednesday, June 16, 2010. Lionsgate’s Board of Directors urges shareholders to continue to protect your investment and reject this financially inadequate, coercive and opportunistic offer by not tendering your shares and affording Carl Icahn control of Lionsgate. If you have already tendered your shares, we strongly recommend that you withdraw them. All of Lionsgate’s directors and executive officers have informed Lionsgate that they do not currently intend to tender their shares into the offer.

We are confident that the Icahn Group will not obtain control of Lionsgate, regardless of the additional shares recently tendered into the Icahn Group’s offer. A vast majority of shareholders have shown their support for the Company’s strategy and continue to reject the Icahn Group’s inadequate offer. As reflected in our most recently reported results, Lionsgate’s strategy is working. We will continue to create value for our shareholders.

ICAHN HAS A HISTORY OF DESTROYING SHAREHOLDER VALUE

Carl Icahn has a long history of destroying shareholder value once he obtains control of a company or even board representation:

· Blockbuster’s share price declined by 96% when Mr. Icahn was a board member.[1]

· During Mr. Icahn’s tenure as chairman of the board of WCI Communities, its equity value decreased to virtually zero (share value decreased by 99.8%).[2]

o Mr. Icahn became chairman of the board of WCI Communities after a failed tender offer and prolonged proxy fight. While on the board, Mr. Icahn oversaw tremendous losses, and the company was unable to obtain needed financing.

o One year after Mr. Icahn joined its board, WCI Communities filed for bankruptcy.

· At BKF Capital, Mr. Icahn’s nominees who were elected to its board oversaw a decrease in value of 92%.[3]

· During Mr. Icahn’s tenure as chairman of the board of XO Holdings, share value decreased 80%.[4]

o While at XO, Mr. Icahn altered different areas of its capital structure, and XO’s minority shareholders have filed a lawsuit alleging, among other things, that such alterations were to the detriment of minority shareholders. This precedent raises legitimate and disturbing questions about Mr. Icahn’s motives in offering Lionsgate a bridge facility.

· American Railcar, an entity controlled by Mr. Icahn, declined by approximately 68% since its highest level in 2007.[5]

In addition to our concerns about Carl Icahn’s record of value destruction, Mr. Icahn’s involvement on the board of directors of Blockbuster specifically underscores serious questions about his obvious lack of knowledge and understanding of the media business.

During Mr. Icahn’s tenure on the Blockbuster board:

· Blockbuster reported greater than $1.4 billion in losses;[6] and

· Blockbuster’s share price plummeted from $10.05 per share to $0.40 per share – a colossal decline in shareholder value of 96%.[7]

Mr. Icahn stepped down from Blockbuster’s board and sold a substantial portion of his stake at a fraction of his original investment after the company’s market capitalization declined by nearly $2 billion.[8]

The Wall Street Journal best summarizes Mr. Icahn’s Blockbuster failure:

“Next time, Carl Icahn should just read a book. Back in 2005, when the investor was campaigning for seats on Blockbuster’s board, he disputed suggestions that its video-rental business was dying by pointing to his experience with the chain. After playing tennis most Saturdays, he dropped by his local outlet where he sometimes had to wait for 15 minutes to rent a video. A good movie was ‘the only escape you get.’

“As is no secret, he was successful — sort of. He got a seat on the board. But five years later, with the company now in financial straits, Mr. Icahn has relinquished his board seat. And Wednesday he disclosed he had sold a big chunk of his stake for as little as 18 cents a share. Given that he paid as much as $9 for his shares, he looks likely to lose most of his $191 million investment. That ain’t no blockbuster.”[9]*

Furthermore, we find it ironic that Mr. Icahn berates Lionsgate’s stock performance in light of the steep decline in value of Mr. Icahn’s own flagship fund, Icahn Enterprises. Shares of

Icahn Enterprises declined to $38.74,[10] from its 2007 high of $134.00 – an approximately 71% loss for investors in Icahn Enterprises.

If Mr. Icahn cannot create value in his own funds, how can he do so in an industry in which he has limited and unsuccessful experience?

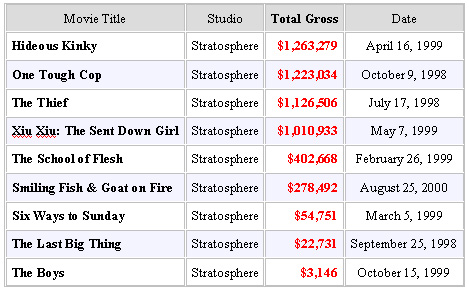

ICAHN’S EXPERIENCE DISTRIBUTING LOW BUDGET FILMS WAS AN ABJECT FAILURE

In September 1997, Mr. Icahn formed Stratosphere Entertainment with Paul Cohen with the intent of releasing 12 low-budget films annually that were predicted to each gross between $3 million and $30 million worldwide.[11] Mr. Icahn’s company sustained significant losses and never had a film gross over $1.5 million at the U.S. box office. The highest grossing film was Hideous Kinky, which earned only $1.3 million at the U.S. box office and cost over $12 million to produce.

The results of the movies released by Icahn’s company (based on US Box office figures from www.boxofficemojo.com) are clear:

Note: Total Gross does not include additional releases, if any.

After 18 months of losing money, Mr. Icahn replaced Mr. Cohen with Richard Abromowitz, and Stratosphere continued to deliver box office failures. Stratosphere floundered for another year, and in 2000 it ceased activities.

It is noteworthy that in 1997, when he started Stratosphere, Mr. Icahn told The New York Times that he did not need to know about films to make money with them.[12] Today, Mr. Icahn does not “personally claim to be a visionary in regard to any particular industry.”[13]

Clearly, Mr. Icahn did not know how to run a movie company back in 1997 when he founded Stratosphere and has done nothing to prove that he knows how to run one now. Do NOT let him destroy the value of Lionsgate. Do NOT tender your shares to him for U.S.$7.00 per share.

ICAHN HAS NO COHERENT STRATEGY FOR LIONSGATE

Mr. Icahn has yet to articulate a clear business plan for Lionsgate. He has, however, on numerous occasions, made unsubstantiated, incorrect and inflammatory remarks to gain attention and traction for his inadequate offer.

DON’T BE FOOLED BY ICAHN’S SCARE TACTICS

Mr. Icahn has made statements designed to create fear, uncertainty and doubt in shareholders’ minds in an attempt to buy Lionsgate’s shares cheaply.

Just last week, in his June 11, 2010 letter to Lionsgate shareholders, Mr. Icahn proclaimed that, “If these defaults were to be triggered and you are unable to obtain the necessary waivers or an alternative source of financing (a huge uncertainty, given the current state of the debt markets), Lions Gate’s assets may not be sufficient to repay this debt in full.”

As we have said, Lionsgate continues to engage in discussions with its lenders regarding a potential waiver or amendment to its credit facilities in order to prevent a potential event of default and is confident in its ability to obtain one in the near future if Mr. Icahn’s actions make it necessary. We will welcome the opportunity to review the actual terms of a proposed bridge facility from Mr. Icahn. We formally requested that Mr. Icahn disclose those terms to the Company and to the public. To date, Mr. Icahn has not shared any of those terms.

Shareholders should consider that if the Icahn Group really believes that Lionsgate’s equity is worthless, would it be tendering to acquire up to all of the Company’s shares at U.S.$7.00 per share? Don’t transfer the value of your Lionsgate investment to Mr. Icahn in response to his unfounded threats.

This is similar to the Icahn Group’s failed tender offer for Lionsgate’s senior convertible notes at $0.73 and $0.75 on the dollar in March 2009. Today, these debt securities trade at $0.96-$0.98 on the dollar, approximately 31% more than Mr. Icahn offered for them last year.

ICAHN’S OFFER REMAINS INADEQUATE AND SHOULD BE REJECTED

The financial inadequacy of the Icahn Group’s offer has become more pronounced since the time that the original offer was launched, as Lionsgate continues to successfully execute its business strategy. The average price target of Wall Street analysts for Lionsgate shares as of June 11, 2010 is $8.85, a 26.4% premium to the Icahn Group’s offer price of U.S.$7.00 per share.

MANAGEMENT’S STRATEGY IS WORKING

Lionsgate’s management has a clear strategy that is delivering on its promise to build value for shareholders.

Our business is on track and we continue to build our world class media platform. Over the past 10 years, Lionsgate has grown from a little independent studio distributing primarily art house films into a nearly $1.7 billion diversified global entertainment corporation. While we have tremendous value built up in our library, our backlog and our franchises, we remain, first and foremost, a growth company. As evidence of the strength of our business, during this period:

· Revenues have increased eightfold;

· Theatrical box office market share has improved tenfold;

· Our library of titles is up 15 times over; and

· Television revenues have grown by a factor of 40 since 1999.

As we have consistently stated, we believe the Company’s interests are best served by continuing to execute our business strategy, which has been delivering demonstrable results and value to all shareholders. Our recently released fiscal 2010 results further support this successful strategy. Lionsgate is poised to deliver exceptional value to our shareholders from the portfolio of assets we have been steadily building.

Regardless of the additional shares recently tendered into the Icahn Group’s offer, we are confident that the Icahn Group will not obtain control of Lionsgate through its tender offer, as a vast majority of shareholders have shown their support for the Board and management’s strategy and rejected the offer.

Lionsgate urges shareholders to protect the value of your investment and continue to reject the Icahn Group’s inadequate offer by NOT tendering your shares now, or during the subsequent offering period. For those who have already tendered your shares, you must act NOW to withdraw them promptly.

If you have any questions or require assistance withdrawing your shares, please call MacKenzie Partners at (800) 322-2885.

We sincerely appreciate your continued support and confidence.

Sincerely,

Jon Feltheimer

Co−Chairman and Chief Executive Officer

Michael Burns

Vice Chairman